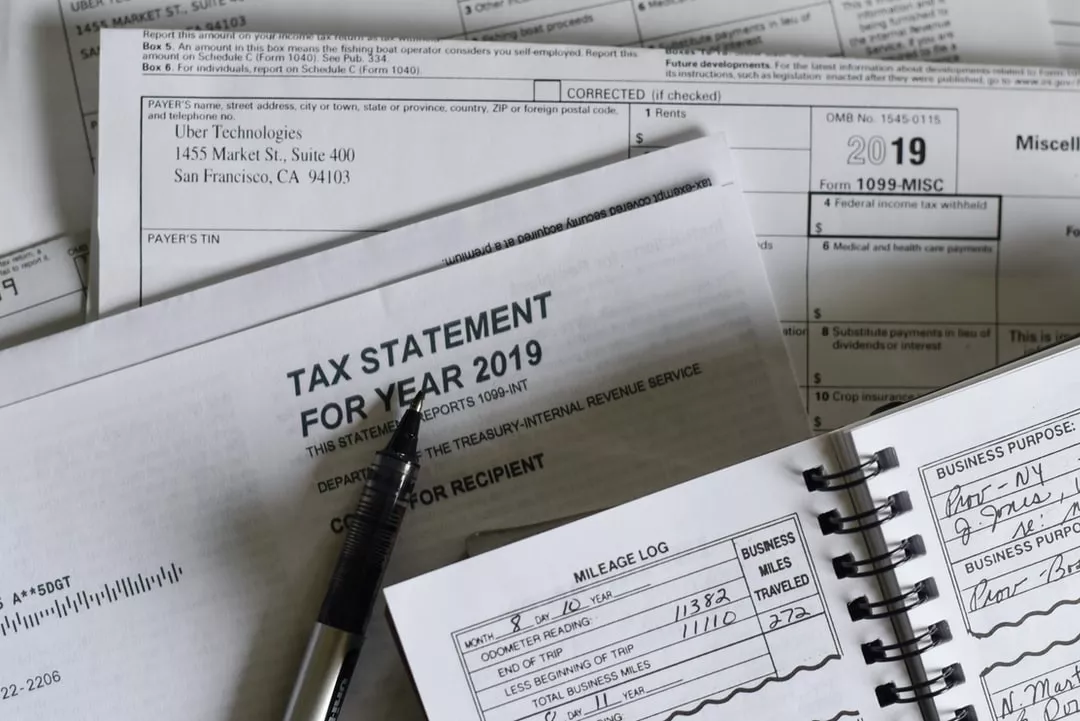

A tax preparer can help you find all of the deductions and credits to which you are entitled, so you can get the most money back from the IRS. If you have a lot of income from investments or you’re self-employed, you might also need a tax preparer to help you file your tax return. Tax preparers are familiar with the tax laws that apply to these types of income, and they can help you make the most of your tax deductions. When looking for a tax preparer, it’s important to compare pricing between firms and make sure you understand all associated fees. You should also see what services they offer. Once you have selected a preparer, be sure to sign a contract with your CPA so that there is no confusion about the services to be provided. Keep reading to learn more about tax preparation services in Indianapolis and how you can find the ideal CPA for your needs.

Compare pricing between firms and learn about fees.

When looking for a CPA, it is important to compare pricing between firms and to understand all associated fees. Some firms charge a flat fee, while others charge by the hour. Additionally, some firms may charge for additional services, such as the preparation of amended returns. When comparing pricing, be sure to ask about any discounts that may be available. Many firms offer discounts for early payment or for multiple returns. It’s also important to ask about the experience of the preparer. The IRS has specific requirements for the preparation of tax returns, and it is important to ensure that the preparer is familiar with these requirements. Finally, be sure to ask about the firm’s policy on refunds. Some firms will refund the entire amount of the fee if the return is not accepted by the IRS. Others may only refund a portion of the fee.

Understand the different services offered.

When looking for a tax preparation service, it is important to understand the different services offered. The most common services are preparation of federal and state tax returns, tax planning, assistance with audits, assistance with estate and gift taxes, assistance with payroll taxes, and assistance with international taxes. The best way to find the right tax preparation service for your needs is to ask around. Talk to friends, family, and colleagues to see if they have a service they recommend. You can also do a search online for reviews of tax prep services in Indianapolis.

Sign a contract.

Once you’ve chosen a tax preparer, you can sign a contract with them. This document will outline the specific services that the preparer will provide, as well as the fees that they will charge. It’s important to read this contract thoroughly before signing to make sure that you understand what you’re getting into. The contract should also specify what happens if the preparer makes a mistake on your return. In most cases, the preparer will be responsible for fixing any errors, and they will also be responsible for any fines or penalties that are assessed as a result of those errors. It’s important to know what to expect in the event of a mistake, so you can be prepared for the costs involved. If you have any questions, be sure to ask the preparer before agreeing to anything. Also, be sure to read the contract carefully before signing anything. The contract should specify the services that will be provided, the fees that will be charged, and the terms and conditions of the agreement.

If you choose a reputable tax professional with years of experience like at Pattar CPA, then you should find no issues and get the help of reliable accounting services throughout the process.